Every Organization Needs a Budget

No matter how small your museum is, the budget is your blueprint for daily operations. Having and following a clear budget is crucial to ensuring that your organization achieves its mission without becoming insolvent. If you have a paid or designated volunteer director, they should work with the Finance Committee of the board of trustees to prepare the budget. The entire board approves the annual budget as part of its oversight of the organization. Many of the resources below apply to all kinds of nonprofit organizations — and they also apply to your museum.

In this page, you will find a guide to defining your fiscal year, an explanation of how to prepare and finalize a budget, and some tips for managing a budget.

Defining Your Fiscal Year

The fiscal year of an organization is set in the bylaws and it serves as the time frame in which all of the organization’s financial transactions occur. Typically lasting 12 months, the fiscal year need not align with the calendar year. Instead, the dates that your organization selects should take into account three things:

1) Dates of the museum’s programs, including moments of high traffic and low traffic with visitation.

2) The fiscal year of the primary funding source for your organization.

3) Opportunities for fiscal review, typically during low-traffic times in your calendar.

For example, if your organization experiences the highest traffic during the spring and summer, performing a fiscal review during the fall or winter makes the most sense. A fiscal calendar in this case could be from October 1 to September 30th. If your museum receives much of its operating budget from your county, you may want to use its fiscal year even if you are not a government unit. However, nonprofits are able to select their own fiscal year-end. Here are some tips on how to make this decision from the American Institute of Certified Public Accountants.

Preparing and Finalizing the Budget

After establishing the dates for your fiscal year, you’re ready to start preparing your budget. In this section, we’ll be discussing how to construct an annual operating budget, but it’s important to note that this budget will draw from many other specific project budgets. An institution must be prepared to develop and manage multiple budgets in a year.

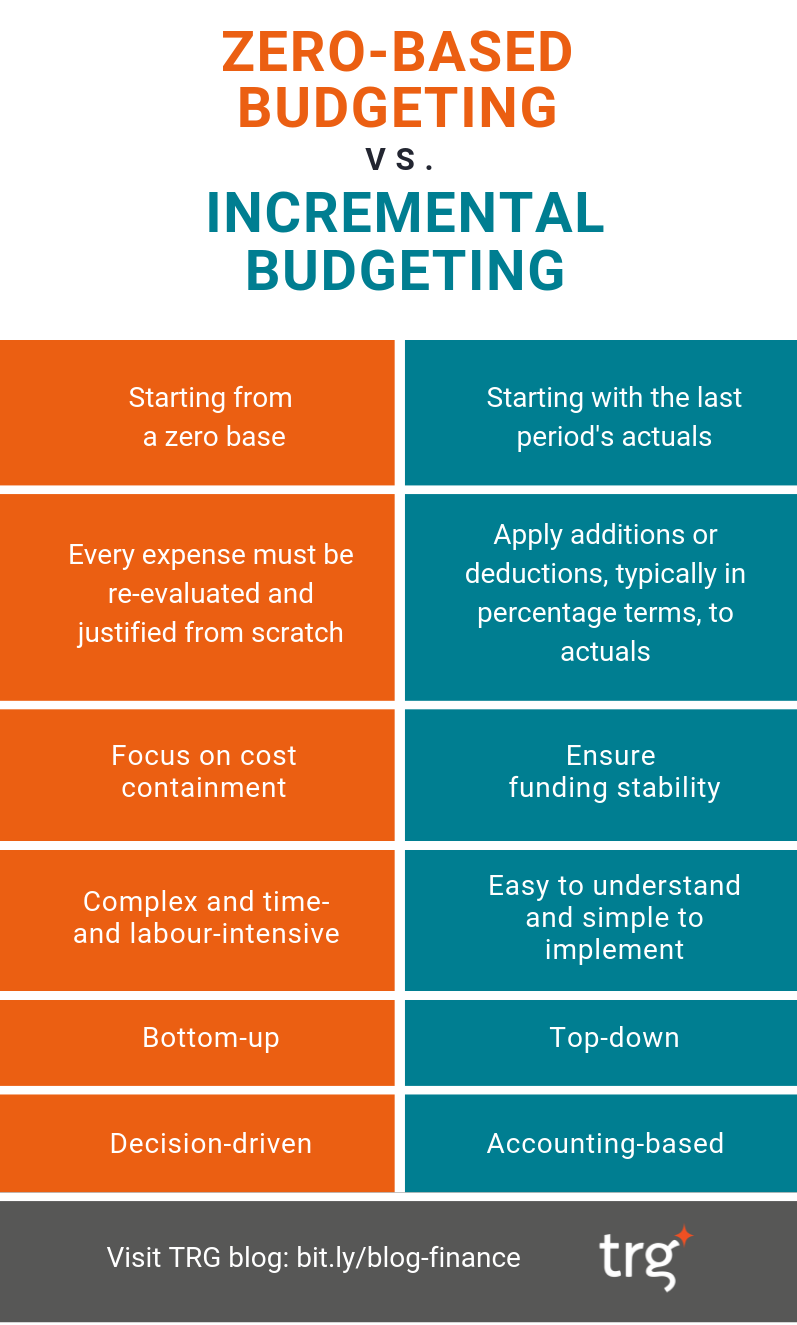

There are two ways to approach an annual operating budget. In traditional or incremental budgeting, you begin by reviewing budgets from previous years to see where and when the money was spent. Then, you use your past budgets as a guide for the next year. Your budget should reflect your mission statement and strategic plan; these documents state your organization’s priorities for the next few years and should serve as a guideline for apportioning money.

If your institution’s budgets from previous years no longer reflect its mission statement or strategic plan, you can try zero-based budgeting. In zero-based budgeting, you build the budget from scratch, re-evaluating and re-justifying each expense. This kind of budgeting is more time-consuming and most helpful when an institution wants to shift its priorities through a new strategic plan or new goals.

The next step is to determine where you will find the money to fund these projects. When is the planned income expected to arrive? Will there be fluctuations in the amount given from previous years that need to be taken into account? If you have earned income from sources such as admissions fees, a museum store, or membership fees, what were the numbers from previous years?

Regardless of your budgeting approach, establishing anticipated income before writing the formal budget can help you determine what your fundraising needs and programmatic costs will be for the coming year. Some nonprofits even use a short-term credit line to even out the money flow over the fiscal year. Advice on using loans in this way can be found in this article from Nonprofit Quarterly.

Now that you’ve established your anticipated income, you can estimate the cost to operate your organization for the upcoming year. This should include calculating the cost of staff salaries and benefits, utilities and routine maintenance and repair, and any programs that you will be offering. Under an incremental budgeting model, most of this information can be extrapolated from the budgets of previous years. Meanwhile, zero-based budgeting will require you to calculate each of these expenses from scratch. This allows an institution to retool its spending to prioritize the programming most relevant to its mission statement, but again takes more time to craft.

Finally, it is the duty of the board of trustees to review and approve the final budget. It is crucial to keep in mind that, as the body providing legal oversight of the organization, it is also the duty of the board to ensure that any fundraising needs are met.

More resources for preparing your own budget

- The National Council of Nonprofits has published a clear, well-written comprehensive guide for nonprofit budgeting.

- The Greater Washington Society of Certified Public Accountants Educational Foundation offers a detailed and useful set of resources on its web page Nonprofit Accounting Basics, including a list of helpful budgeting categories and concepts.

Managing the Budget

After the board of trustees reviews and approves the budget, either the executive director of the organization or, in the case of volunteer-run organizations, the president of the board, monitors how money is spent day-to-day. All organizations need policies guiding expenditures. For instance, an organization might require that all reimbursement requests must have receipts.

Further, all organizations need a set of routines that are called internal controls, which prevent the misuse and misappropriation of assets. These include up-to-date financial reports for every board meeting and a policy stating how the organization will keep track of expenses for (and revenues generated by) every given project or division within the organization. For more information on establishing internal controls and examples of their implementation, visit the National Council of Nonprofits.